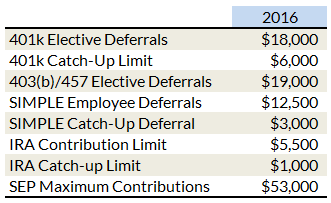

Bad News for Retirement Plan Contributions in 2016 - 401kRollover - Retirement Plan Contributions

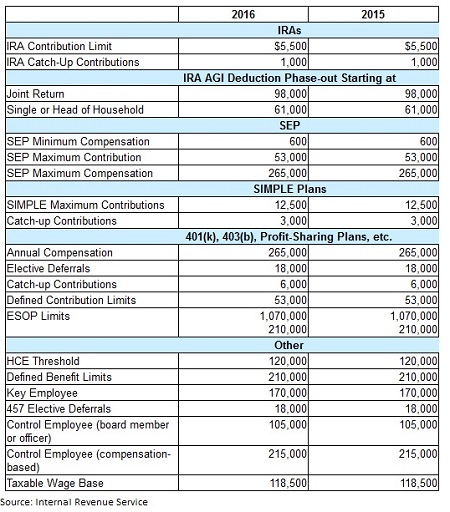

IRA 2016 Pension Plan, 401(k) Contribution Limits – Brightwood Ventures LLC - IRA 2016 Pension Plan, 401(k

2016 401k & IRA Contribution Limits - 2016 401k & IRA Contribution Limits

Historical 401(k) Limit: Contibution Limits from 1978 to 2024 - DQYDJ - Historical 401(k) Limit: Contibution

2016 401k Contribution Limits Stay the Same • Novel Investor - 2016 401k Contribution Limits Stay the

Historical 401(k) Limit: Contibution Limits from 1978 to 2024 - DQYDJ - Historical 401(k) Limit: Contibution

Bad News for Retirement Plan Contributions in 2016 - 401kRollover - Retirement Plan Contributions

Maximum 401(k) Contributions in 2016: Same As in 2015 | Money - Maximum 401(k) Contributions in 2016

401(k) Contribution Limits for 2022 and 2023 - 401(k) Contribution Limits for 2022 and

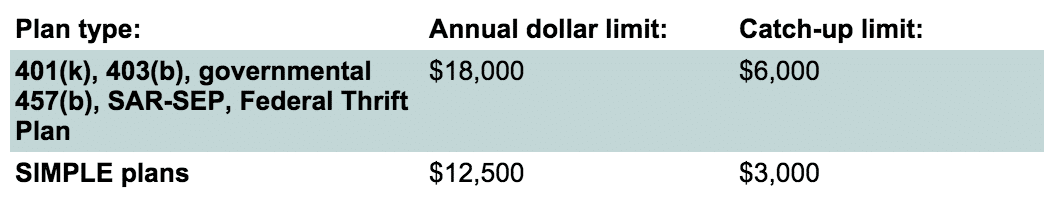

Catch-Up Contributions - Catch-Up Contributions

Why you should max out your 401(k) in your 30s - Why you should max out your 401(k) in

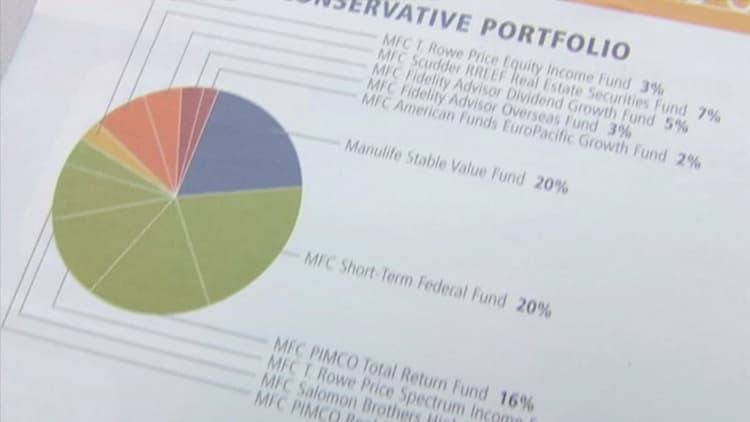

Boeing Frontiers Online - Boeing Frontiers Online

IRS Announces 2016 Retirement Plans Contribution Limits For 401(k)s And More - Retirement Plans Contribution Limits

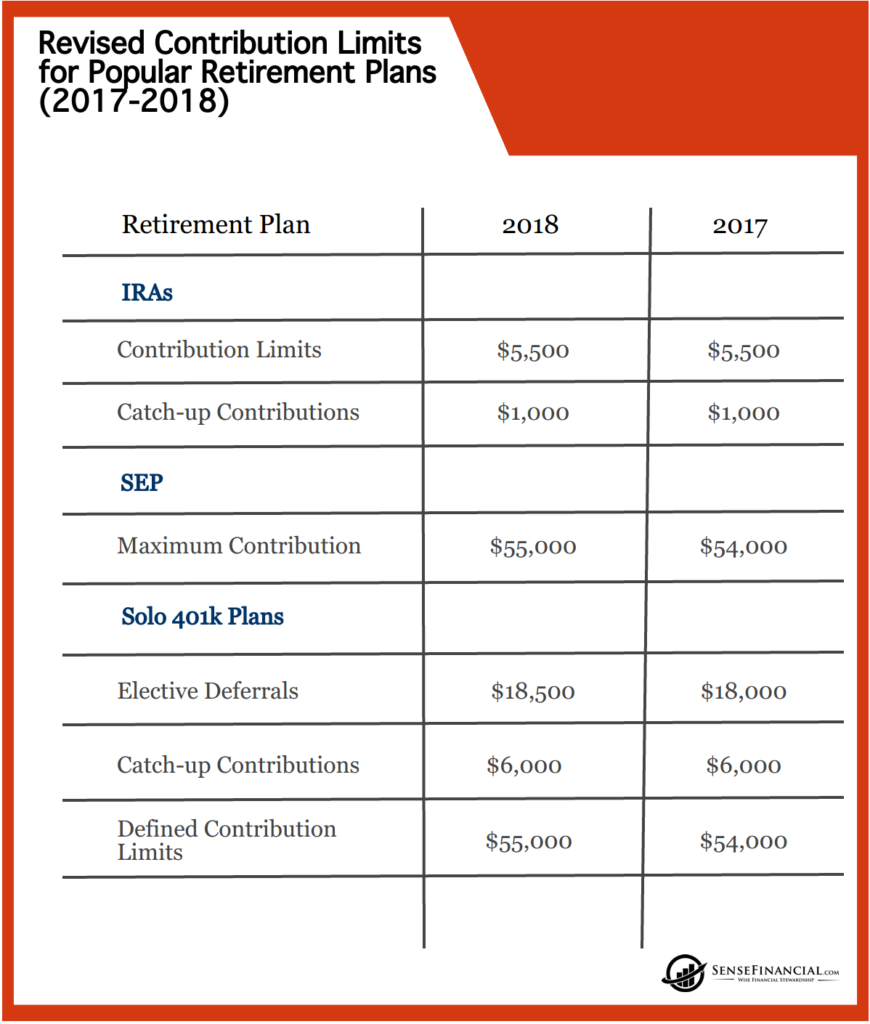

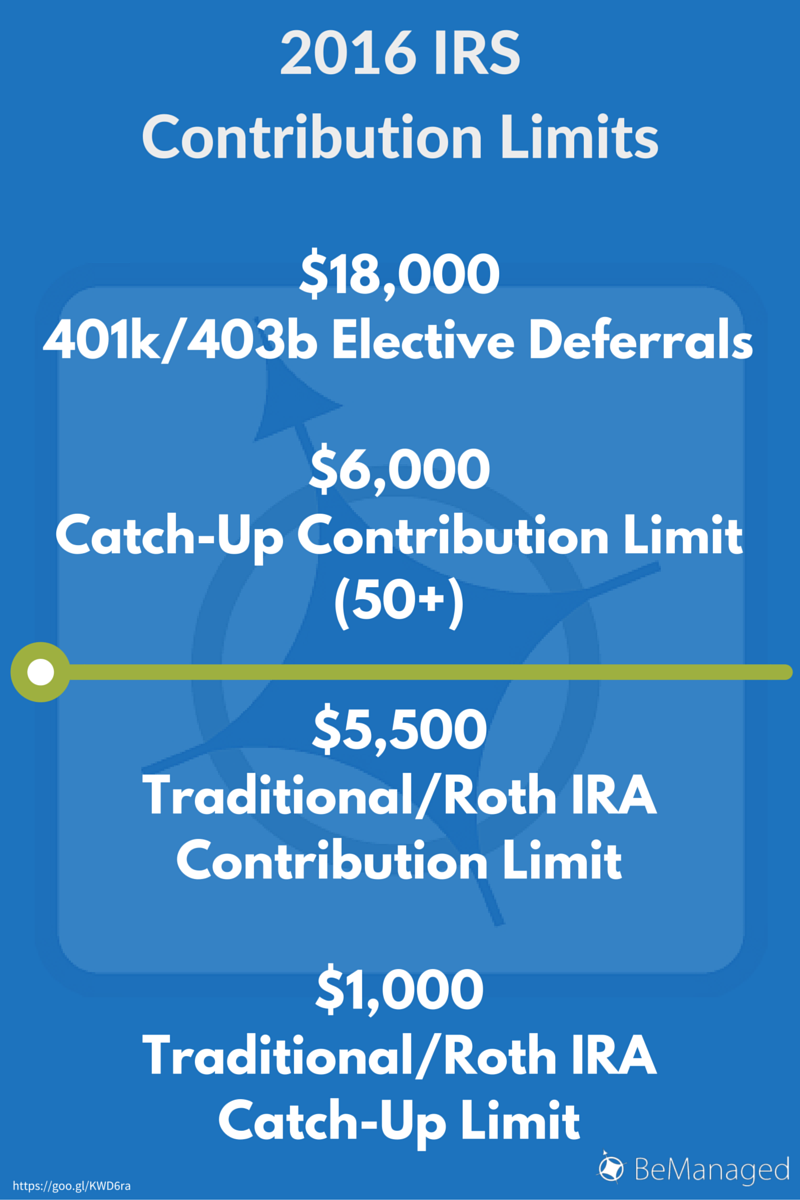

Infographics: IRS Announces Revised Contribution Limits for 401(k) - Revised Contribution Limits for 401(k

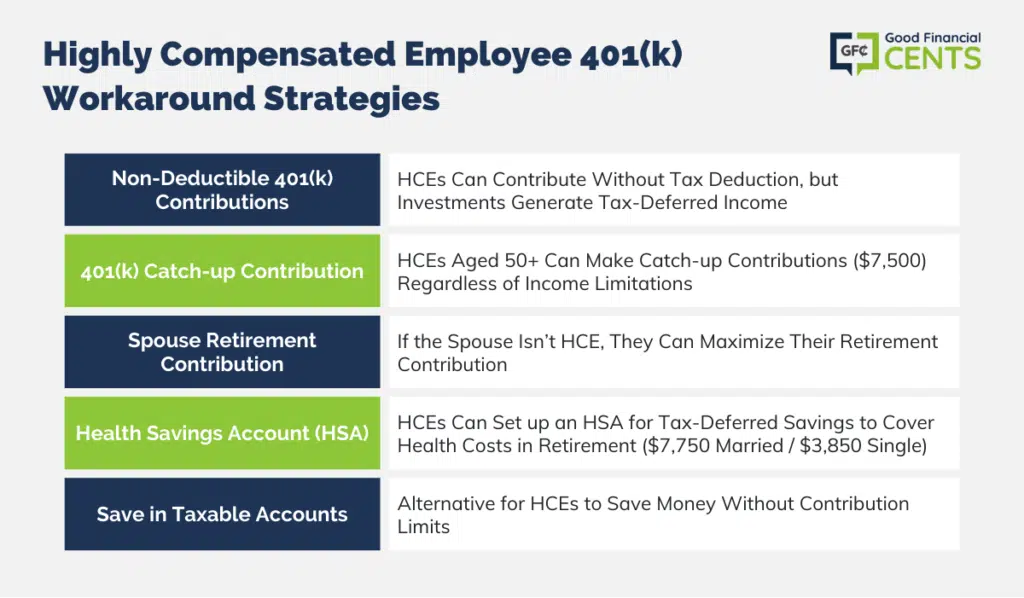

401k Limits for Highly Compensated Employees in 2023 - 401k Limits for Highly Compensated

What's New for Retirement Saving for 2024? | SEIA | Signature Estate & Investment Advisors - Retirement Saving for 2024

Top 9 Reasons To Make 401(k) Catch-up Contributions | Bankrate - Catch-up Contributions

Infographics: Why Choosing a Roth Solo 401 k Plan Makes Sense? - Why Choosing a Roth Solo 401 k Plan

Reporting Self-Directed Solo 401k Contributions on TurboTax - My Solo 401k Financial - Solo 401k Contributions on TurboTax

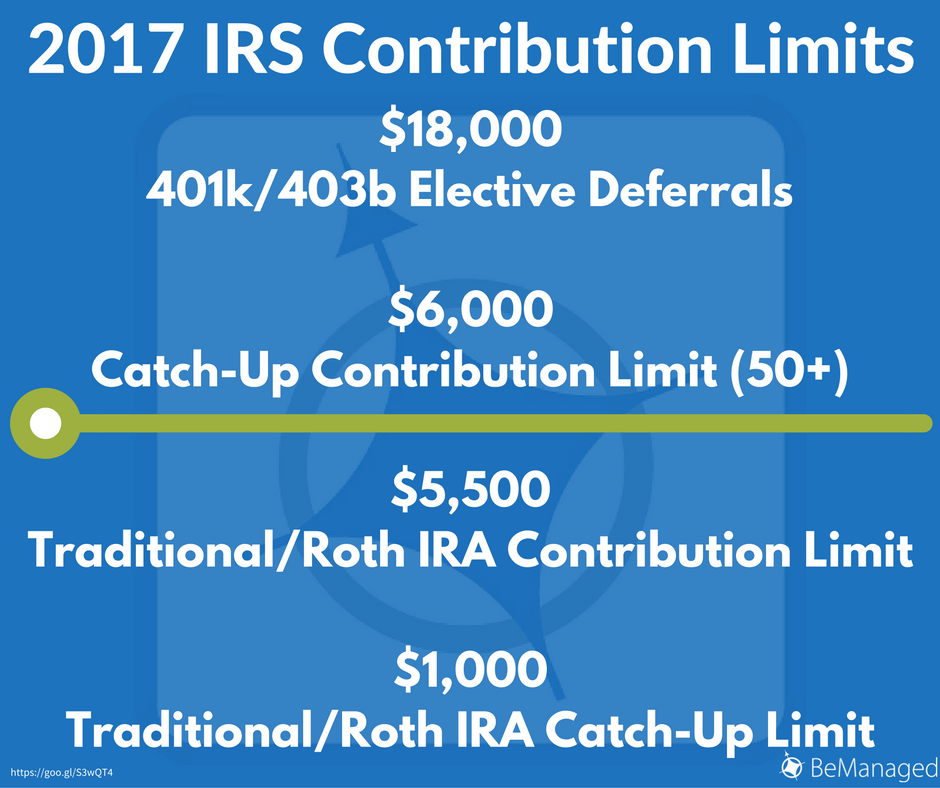

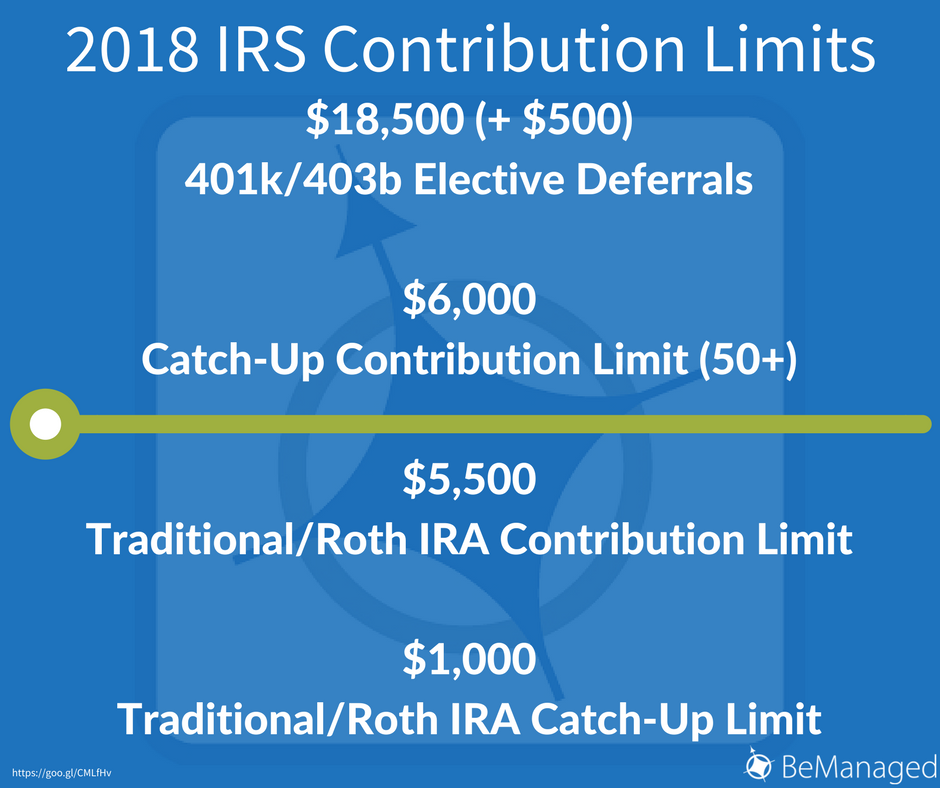

Personal finance Archives - BeManaged - personal finance Archives - BeManaged

-

Retiring in 2016? What You Need to Do Now - Retiring in 2016? What You Need to Do Now

401(k) Contribution Limits for 2022 and 2023 - 401(k) Contribution Limits for 2022 and

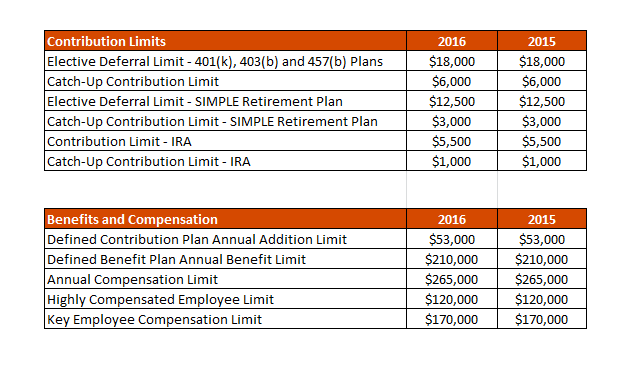

IRS Announces 2016 Pension Plan Limitations; 401(k) Contribution Limit Remains Unchanged at $18,000 for 2016 - IRS Announces 2016 Pension Plan

Contribute Additional $1,000 with Solo 401k Contribution Limits for 2017 - Solo 401k Contribution Limits

IRS Pushes Back Changes to 401(k) Catch-Up Contributions - Maner Costerisan - IRS Pushes Back Changes to 401(k) Catch

6 Ways to Get More Out of Your Retirement Plan in 2016 - Retirement Plan

Solo 401k FAQs - My Solo 401k Financial - Solo 401k FAQs - My Solo 401k Financial

2019 IRA Contribution Limits Unchanged For 2020; 401k And HSA Caps Rise| Investor's Business Daily - 2019 IRA Contribution Limits Unchanged

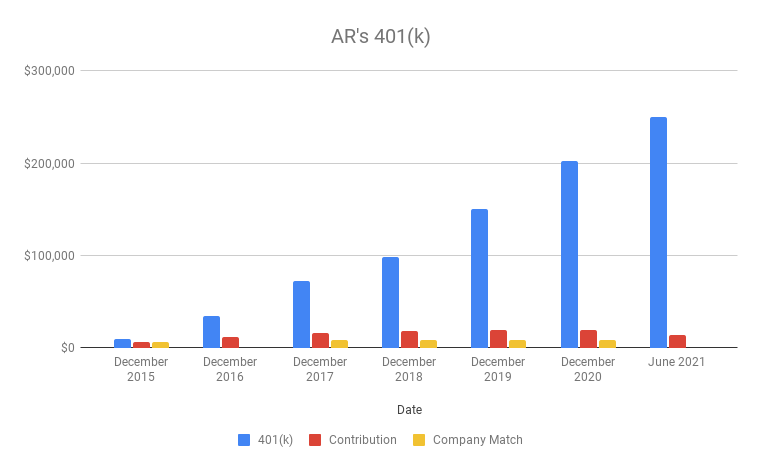

What if You Always Maxed Out Your 401(k)? - DQYDJ - What if You Always Maxed Out Your 401(k

Senate tax tweak would curb pretax 401(k) catch-up contributions - Senate tax tweak would curb pretax 401

Retirement 401k Catchup Contributions | Money - Retirement 401k Catchup Contributions

IRA and Retirement Plan Limits for 2016 You Must Know - H&J Certified Public Accountants - IRA and Retirement Plan Limits for 2016

Personal finance Archives - BeManaged - personal finance Archives - BeManaged

The 401(k) revolution: J. Mark Iwry's mission to simplify retirement planning | Pensions & Investments - simplify retirement planning

What higher earners need to know about 401(k) catch-up contributions - higher earners need to know about 401(k

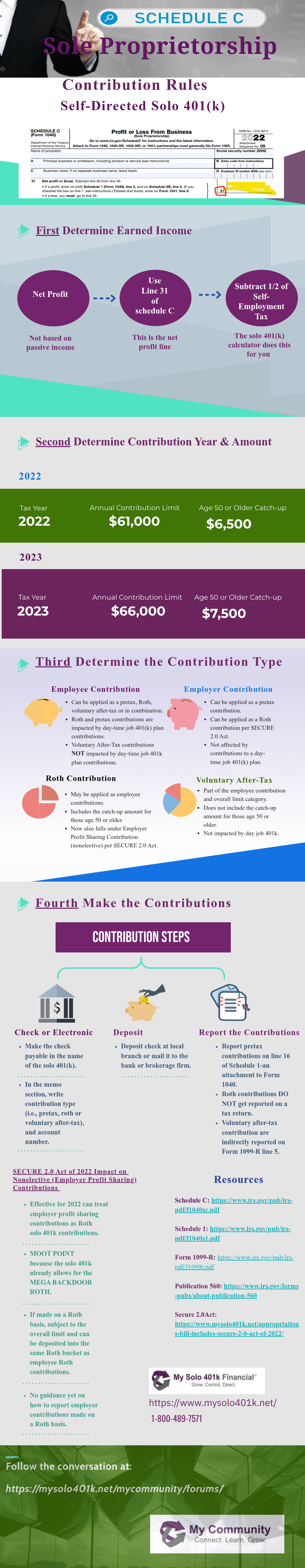

Contribution Types: Self-Directed 401k | Self-Directed Solo 401k | Solo 401k |Solo K - My Solo 401k Financial - Solo 401k | Solo 401k |Solo K

Understanding The Mega Backdoor Roth IRA - Understanding The Mega Backdoor Roth IRA

401K Contribution Limits 2023-2024: Maximum Limits and How They Work - SarkariResult | SarkariResult - 401K Contribution Limits 2023-2024

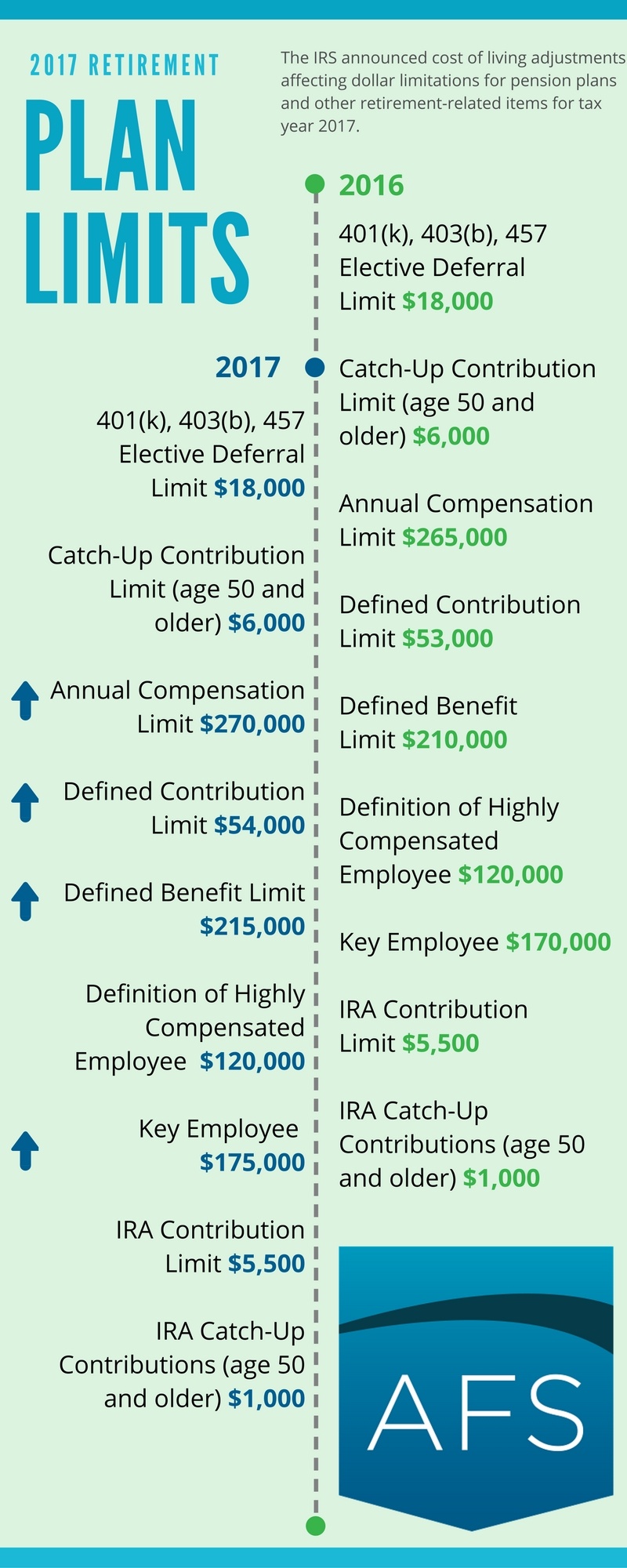

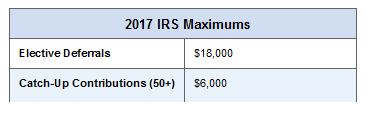

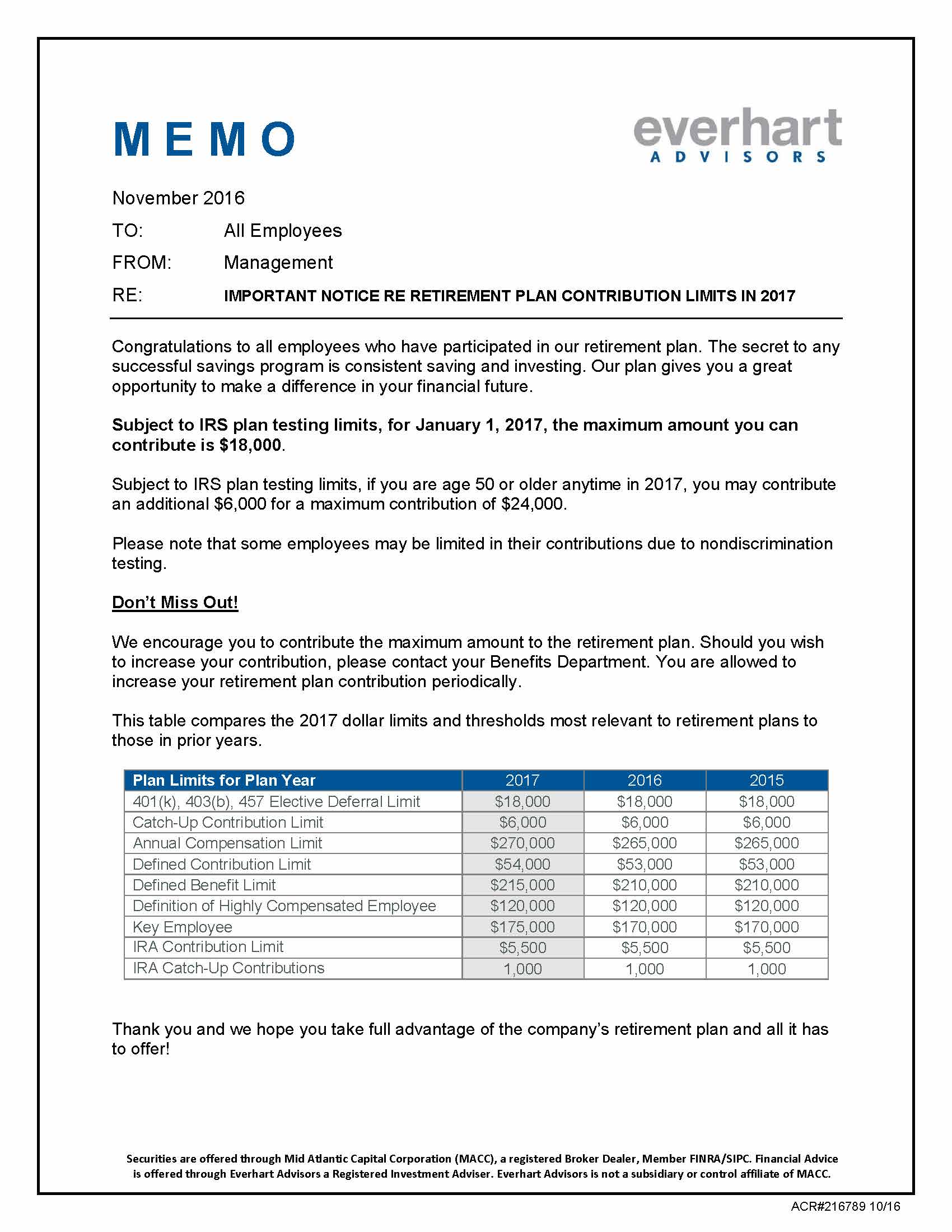

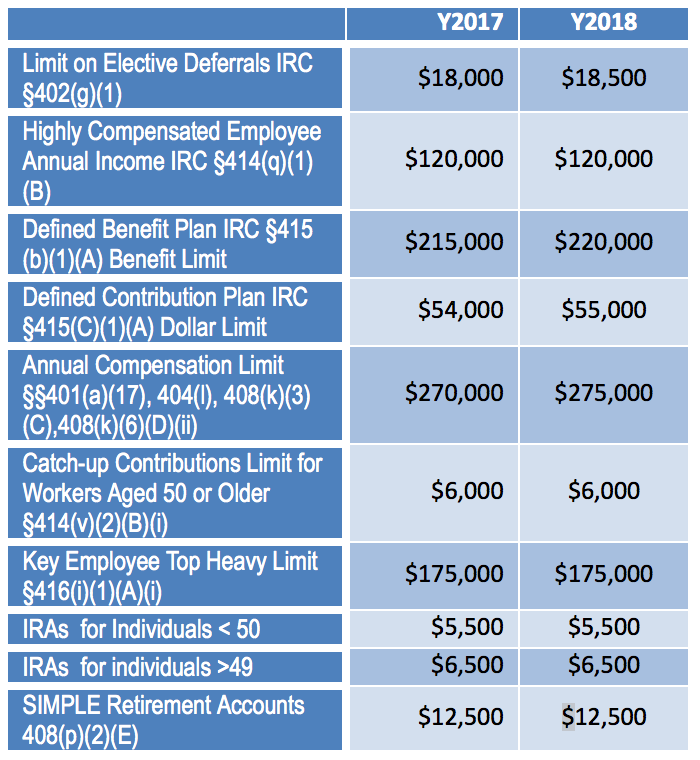

Infographic: IRS Updates 2017 Pension Plan Limits - IRS Updates 2017 Pension Plan Limits

Untitled - Untitled

-

What Are Catch-Up Contributions Really Worth? | Retirement Plan Advisors - What Are Catch-Up Contributions Really

Catch-Up Contributions - Catch-Up Contributions

CORPORATION: Calculating My Solo 401k contributions for a Corporation - My Solo 401k Financial - Calculating My Solo 401k contributions

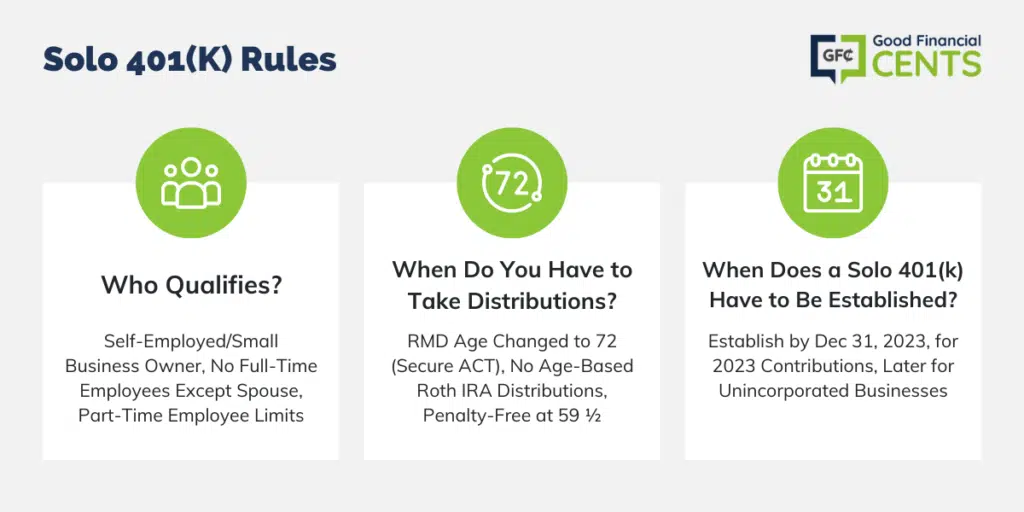

Solo 401(k) Rules and Contribution Limits for 2023 - Solo 401(k) Rules and Contribution

Should You Max Out Your 401(k) in 2024? - Retire Before Dad - Should You Max Out Your 401(k) in 2024

401(k) Retirement Contributions Limits Announced for 2016 - 401(k) Retirement Contributions Limits

Changes to 2023 Retirement Contributions | Fort Pitt Capital - 2023 Retirement Contributions

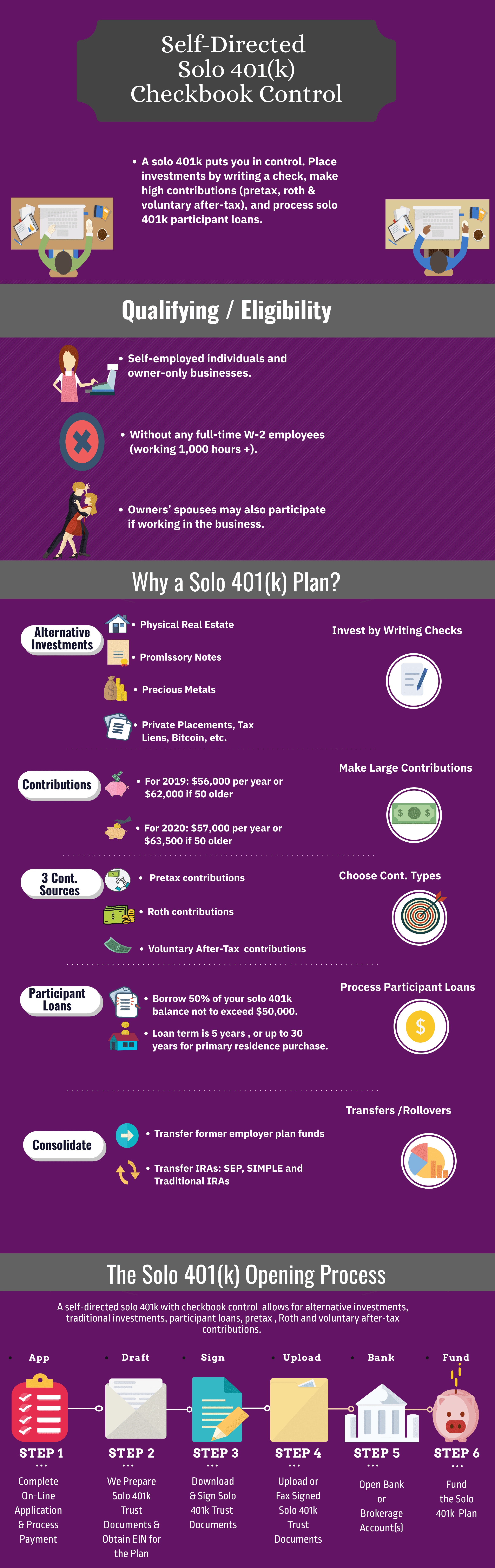

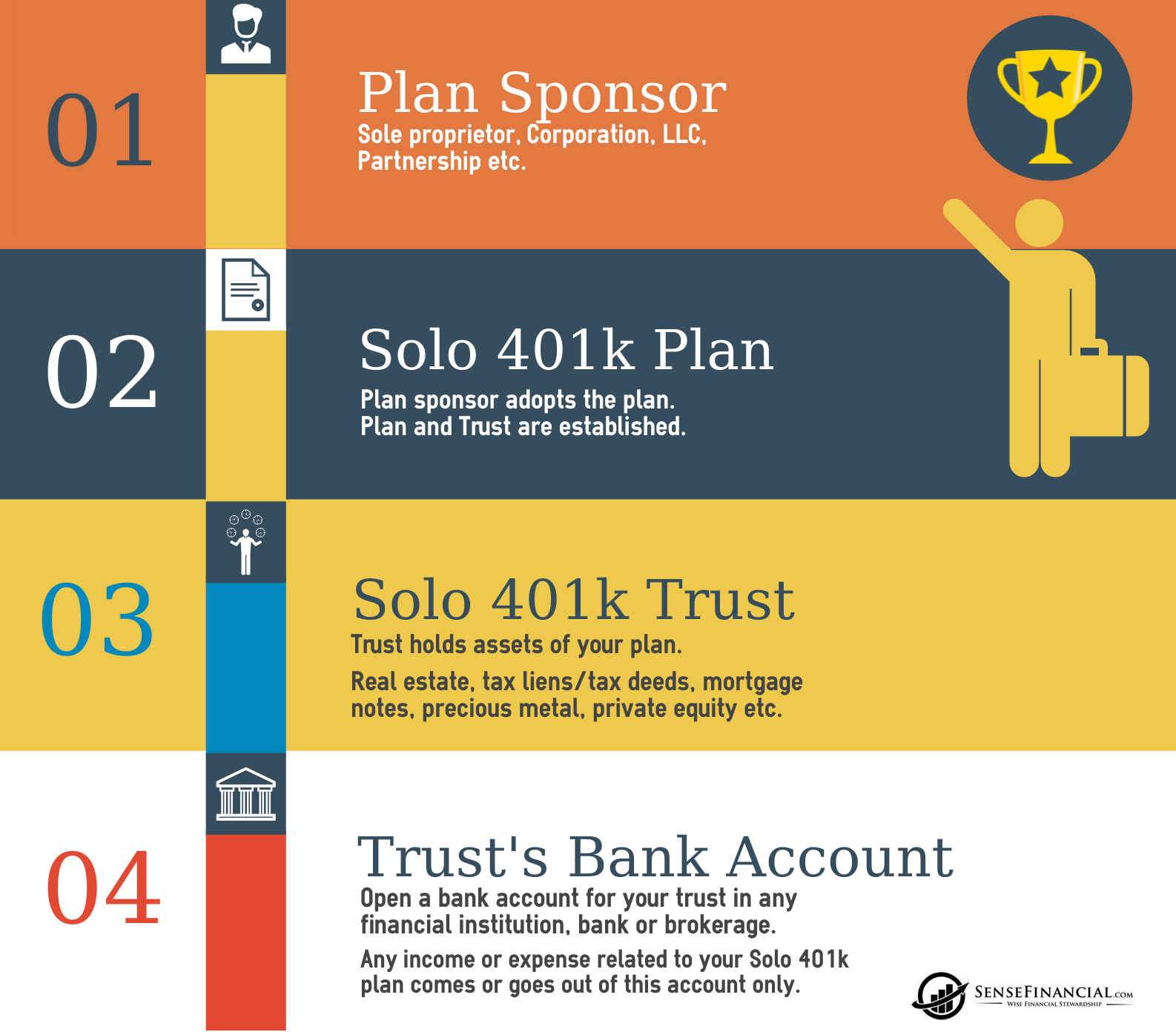

401k Infographics: How does a self-directed Solo k plan work? - How does a self-directed Solo k plan

401(k) Contribution Limits, Rules, and Penalties | Castro & Co. - 401(k) Contribution Limits, Rules, and

IRS Announces 2017 Retirement Plans Contributions Limits For 401(k)s And More - IRS Announces 2017 Retirement Plans

IRS Announces 401(k) and IRA Limits for New Year - IRS Announces 401(k) and IRA Limits for

Savings with Catch-Up Contributions - FasterCapital - Savings with Catch-Up Contributions

401(k) Contribution Limits for 2024 | Good Financial Cents® - 401(k) Contribution Limits for 2024

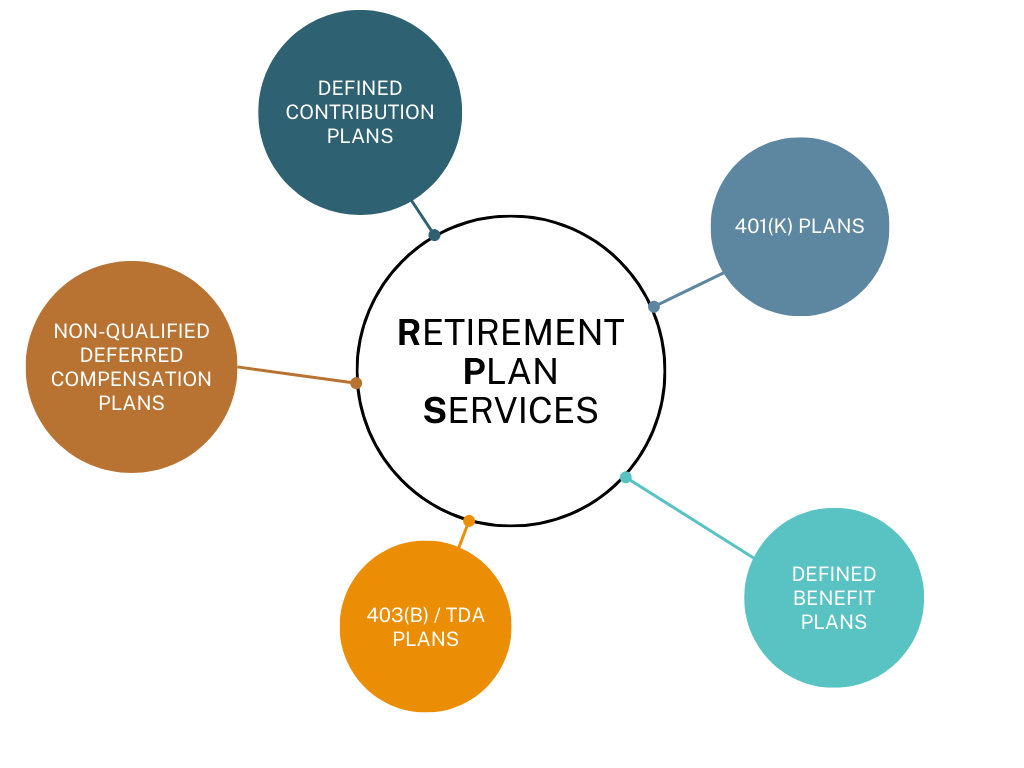

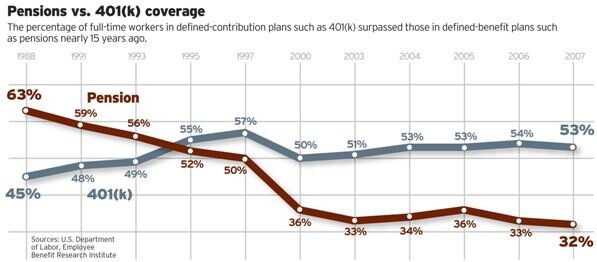

The Shift from Defined Benefit to Defined Contribution Plans | Greenbush Financial Group - Defined Contribution Plans

Playing Catch-Up with Your 401(k) or IRA - Coastal Wealth Management - Coastal Wealth Management

IRS Announces Limits For 2016 Pension Plan Contribution - Limits For 2016 Pension Plan Contribution

401(k) Elective Deferral Limits Archives - Philadelphia Estate Planning, Tax, Probate Attorney Law Practice Limited to: Business, Corporation Law Tax, Probate, Estate Administration, Wills, Trusts - 401(k) Elective Deferral Limits

Retirement 401(k) Plan - Oak Grove School District - Retirement 401(k) Plan - Oak Grove

-

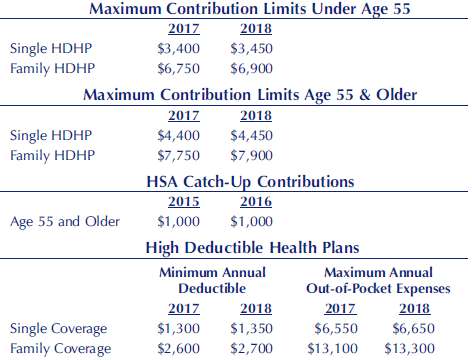

The Pension Specialists" Blog : IRA Contribution Limits for 2018 – Unchanged at $5,500 and $6,500; 401(k) Limits Do Change - IRA Contribution Limits

Cirs 401k - Fill Online, Printable, Fillable, Blank | pdfFiller - Cirs 401k - Fill Online, Printable

The Roth Option: Is It Right for You? - The Roth Option: Is It Right for You?

Here's How Catch-up Contributions Can Grow Your 401(k) Over Time - SmartAsset | SmartAsset - Contributions Can Grow Your 401(k

5 tips to revitalize your retirement, 401(k) plan | king5.com - 5 tips to revitalize your retirement

401(k) limit Graph - IRS CONTRIBUTION LIMITS - Maximum Deferral - Annual Comp Limit - 401(k) limit Graph - IRS CONTRIBUTION

Catch-up 401(k) Archives - Page 2 of 5 - Skloff Financial Group - Skloff Financial Group

Senate tax tweak would curb pretax 401(k) catch-up contributions - Senate tax tweak would curb pretax 401

401K Contribution Limits 2020 — Lansdowne Wealth Management, LLC - 401K Contribution Limits 2020

Average Percentage Reductions in 401(k) Account Balances at Social... | Download Scientific Diagram - Average Percentage Reductions in 401(k

2024 Maximum 401(k) Plan Contribution Limits & Rules - Plan Contribution Limits

Playing Catch-Up with Your 401(k) or IRA Contribution - Financial Planning Tucson | Wellspring Financial Partners - IRA Contribution

Retirement Plans for Workers Who Do Not Have a 401(k) | Kiplinger - Retirement Plans for Workers Who Do Not

Fidelity Investments on LinkedIn: The deadline to make a 2016 IRA contribution is April 18th. This chart can… - Fidelity Investments on LinkedIn: The

Catch-Up Contributions Changes After SECURE 2.0 | Work Force Solutions - Catch-Up Contributions Changes After

401(k) Advice for Your 50s - 401(k) Advice for Your 50s

Build Your Retirement Savings | WorkGroup Payroll - Build Your Retirement Savings

2018 Annual Qualified Retirement Plan Contribution Limits | Experiential Wealth, Inc - 2018 Annual Qualified Retirement Plan

2017 Retirement Plan Limits - Everhart Advisors - 2017 Retirement Plan Limits - Everhart

-

Solo 401k: Calculating My Solo 401k contributions for a Sole Proprietor - My Solo 401k Financial - Calculating My Solo 401k contributions

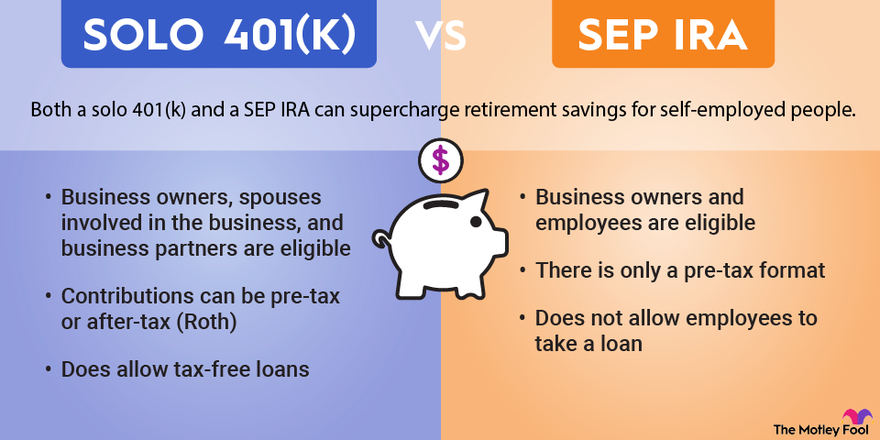

Comparing Small Business Retirement Plans - Comparing Small Business Retirement Plans

Solo 401(k) vs. SEP IRA: Which Is Better for You? | The Motley Fool - Solo 401(k) vs. SEP IRA: Which Is

:max_bytes(150000):strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

:max_bytes(150000):strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)